- Openroom

- Posts

- What's a good credit score?

What's a good credit score?

693 is the average Canadian renter's credit score

Good morning / 早上好 / Bonjour / ਸ਼ੁਭ ਸਵੇਰ / Buen día friend!

In this edition of CEO Notes at Openroom, I’m sharing insights on the state of rental applications across Canada.

Brought to you by our partners at:

SingleKey - Find your ideal tenant with a verified and comprehensive credit, rental, and employment history. Their team embeds Openroom’s data into the reports. Get your 50% off a Tenant Screening Report. Learn more.

Zensurance - Landlord Insurance. If you’re a housing provider, get a no-obligation quote to protect your rental property from damage, loss of rental income, and liability claims. Trusted by over 500K people. Learn more.

Canada’s average renter is 32 years old, with a credit history of 693/900 points, and pays an average of $2,063 for rent.

Our friends at SingleKey looked over hundreds of thousands of datapoints in 2025 to gather their Rental Intelligence Report - it is worth a quick skim through.

I asked ChatGPT to generate me an image based on this report, and this is what it gave me.

Aside: In 60 seconds, AI designed better than I can if I spent 5 hours on it - how incredible is it that we live in 2026 and get to experience this?

AI generated “Average Renter” named Alex who is 32 years old and trying to pay rent on time. Data points are based on the report from SingleKey’s Rental Intelligence Report, Q3-2025.

Why does a credit score matter though?

Your credit score can impact your loan interest rates to credit cards and to rentals. See what Credit Bureau Equifax has to say, like how there are different types of scores and models. Overall, the higher one’s credit is, the more favourable borrowers look at you for lower payments and less interest paid over time.

While it’s not mandatory for a tenant to share their credit history with a future landlord, it’s becoming the norm.

A tip for tenants: there are tools to create a digital verified tenant profile to share with others so a landlord doesn’t run a check on your history again and again. See example.

A tip for landlords: you should always pull your own credit checks unless it comes from a verified source that has updates like the above. We see fraud applications very frequently in market now. See how to spot fake docs.

Top 3 insights which caught my eye in the Rental Intelligence Report

First - Credit scores in the Prairies, Alberta, Quebec, and Maritimes are generally lower in comparison to British Columbia and Ontario. However, we see Toronto’s consumer credit scores are declining (2.9% Year-Over-Year). This is interesting to me because at Openroom, we impact consumer’s Equifax credit scores both positively and negatively.

Second - When looking at a breakdown of provinces, rent consumes about one-third of household income. Add in the debt of each household, naturally, there becomes less disposable income. This is very much in line with the current economic climate.

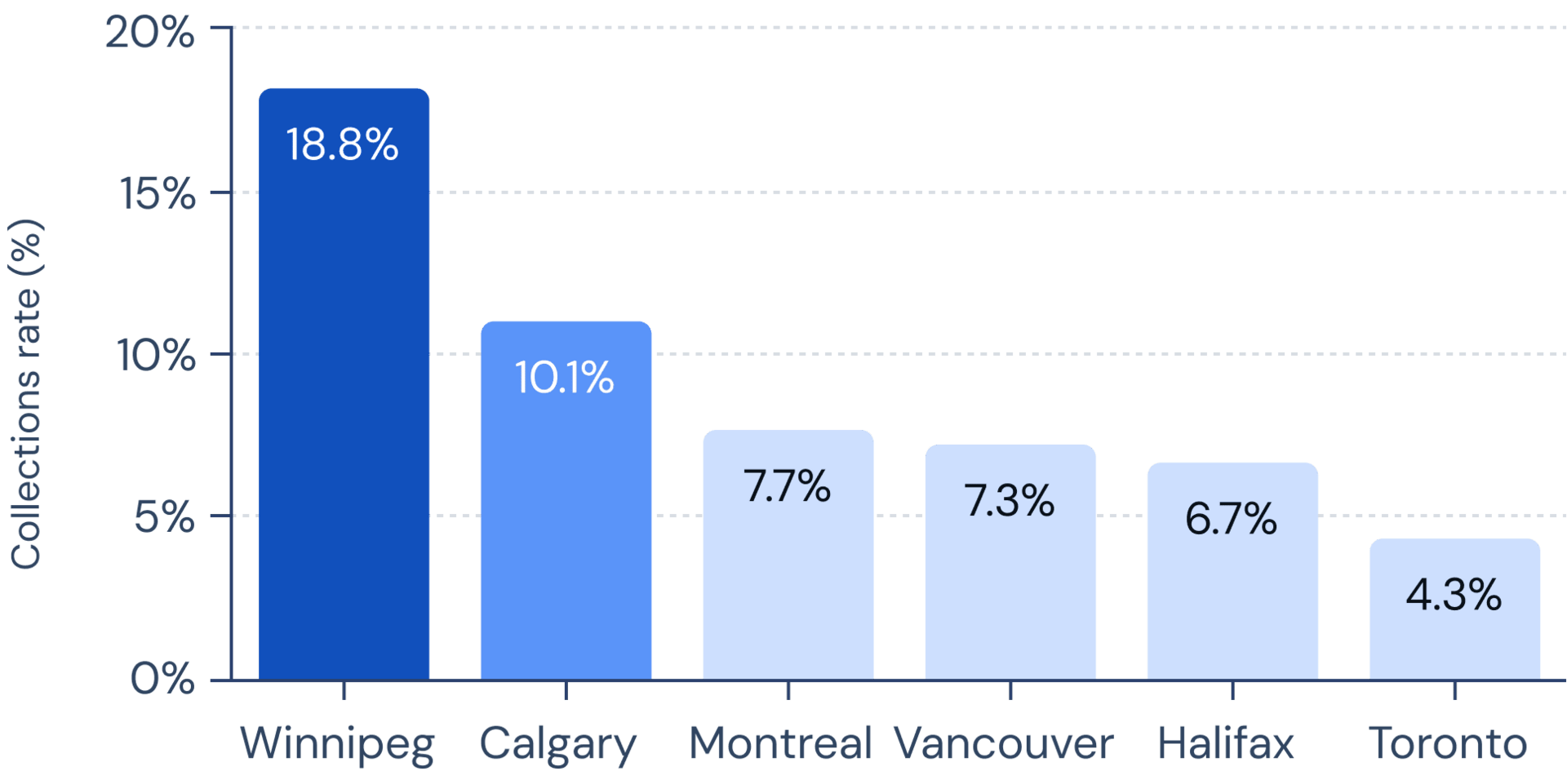

Third - Looking deeper at debt in Canada’s major cities, Winnipeg (Alberta) has nearly 1 in 5 tenants have accounts in collections and the highest bankruptcy rates in comparison to others.

Shameless plug…

Whether you're a landlord or tenant, Openroom gives you (Creditors) the opportunity to report your debtor’s unpaid bills to Equifax.

Won a bad faith eviction case as a tenant, and now your landlord owes you compensation? File it through Openroom.

Had a tenant with unpaid rent, utilities, or other court related costs? File it through Openroom.

We’ll help you automatically calculate interest on the debt, send monthly updated debt balance to Equifax, and email outstanding debt reminders to your debtor. Learn more about the Rental Debt Ledger.

Example of real Collections and Public Records on a Consumer’s Equifax Credit History in redacted form with OPENROOM.CA RENTDEBT as the Data Furnisher Agency.

Overall, you want to know who you are renting to and who you are renting from. You can do preliminary searches for free inside Openroom - we’ve got your back!

What’s on the educational docket this week?

This one is made for housing providers to share the steps of what you should do when there is late or unpaid rent. It’s a useful watch for tenants as well so you know what to expect if you land on hard times and can’t make rent on time.

When my team and I produce videos, you can choose to watch it on Youtube or read it on our site. We try our best to accommodate various formats of learning and make it free so it’s accessible to more Openroom members.

Have topics you think would be good to educate the rental industry on? Reply back to this email and let me know. My team is always on the look out for collaborators or ideas.

Have a great rest of the week!

Weiting Bollu

Mom, Rental Housing Provider, Rental Housing Advocate, Educator, and Openroom Co-Founder & CEO

Openroom collects public tenancy records and connects them to the broader financial credit system to help you make informed decisions on who to rent from and rent to.

We enable you to screen tenants or future landlords, help you report rental debt, give rewards to great residents, or bundle it all into BureauEdge.

We also educate about rental housing and we advocate for a more transparent and connected rental ecosystem to support both responsible housing providers and residents.